Here’s a list of carefully selected fintech software development companies, with useful details about each vendor (expertise, previous projects, set of skills, team composition). It’s based on screening 98 companies and analyzing thousands of reviews. Make a decision based on solid data.

A QUICK SUMMARY – FOR THE BUSY ONES

TABLE OF CONTENTS

These are the top 12 fintech development services providers worldwide. There is no universally best choice, so the companies are sorted by the category that seems to be the most important from the client's perspective - the ability to quickly enter the project and impact its business growth.

What's next?

In the first part of the article, you’ll find graphs where we compare various qualities of the companies. In the second - details about each vendor, along with their area of expertise, skills, and top fintech clients. We also provide you with a few tips about cybersecurity and useful sets of skills.

In this section, we compare how quickly the companies can make an actual influence on your product, and what are their procedures towards achieving the best business results.

A vendor who understands business, not only technology, will make smarter decisions, prioritize more accurately, and finally deliver a better product.

It's all about business-oriented decision making.

Business-success approach manifests by including business analysts in the project from the very beginning or providing support of tech advisors for development teams.

A sign that a software development company will deliver your product according to business needs also manifests in the way they work - when boundaries between business and development are smashed, and they exchange knowledge openly. A smooth flow of know-how between the vendor and your in-house team lays a solid foundation for a successful partnership.

Another good sign is when they challenge your vision and propose better solutions from a business point of view.

Time to impact means how quickly a company can make an actual influence on your product. It depends on how a vendor manages resources, how many formalities they need before they can start, and how much time is needed for onboarding.

The ability to make an impact quickly isn't correlated with the number of developers on board.

Time to impact is also influenced by the way a company organizes projects and by additional products they offer - like workshops. Plus, the presence of tech advisors and tech leaders in a team speeds up the time to first contribution.

Approach to cooperation strongly connects with a company’s culture. To assess it, we’ve analyzed each company’s testimonials and reviews, as well as how vendors write about themselves.

Working in compliance with DevOps culture means, in short, cooperating closely without knowledge hubs. Tons of documentation prolong the development process and make it harder to deliver business results. Close collaboration means understanding, transparency, and higher quality. Frequent and high-quality releases increase the satisfaction of developers – and, subsequently, users of the product.

Companies that work in line with DevOps culture and are willing to share that knowledge are pure gold - you can improve your processes significantly with those players.

How does DevOps culture manifest itself?

You shouldn't need to babysit an external team of developers. And a strong ownership attitude of a team prevents that.

A responsible team isn’t afraid to make mistakes, because they know how to fix them. They accept challenges and responsibilities. The owneship attitude entails more transparency and better communication.

A close partnership between your team and a vendor’s team will facilitate communication, improve transparency and make it easier to achieve joint business goals. It also increases productivity.

A true partnership means sinking into your team when traditional outsourcing is the opposite.

Below, you'll find the details about each fintech software development company from this ranking.

Brainhub is one of the top fintech software development companies that specializes in .NET and JavaScript. This software development agency that helps fintech businesses to accelerate their growth.

The company is an expert in fintech web and mobile app development, having in their portfolio crypto-trading, expense management, and wealth management apps. They worked with startups, small and medium companies, and corporations.

The company has strong UX design skills. They’re experts in increasing customer engagement and improving ROI by delivering financial solutions that meet modern users’ needs. The company offers discovery workshops that can save up to 20% of development time and understands the business side of development projects.

This fintech software development company provides the highest level of cybersecurity and have a set of preventive processes in place.

EXPERTS IN: crypto-trading, managing personal budget, tax management, wealth management, customer and user experience

RANGE OF SERVICES: fintech mobile app development, fintech web app development, custom software development services, cryptocurrency apps, expense management software development, payment solutions, investment software development, fintech UX/UI design, legacy system modernization

TOP FINTECH CLIENTS: Gokong, Coin Panel, PWC

THEY WORKED WITH: startups, medium-sized companies, corporations

TECHNOLOGIES: .NET, JavaScript, TypeScript, Node.js, React.js, React Native, NestJS, Golang, Electron.js, GraphQL, Kubernetes, AWS, Azure, GCP

TALENTS ON BOARD: software engineers, QA engineers, UX/UI designers, business analysts, tech advisors, scrum masters, agile coaches, solution architects, DevOps engineers, delivery managers

REVIEWS:

4.9/5 from 47 reviews (Clutch)

Timeliness: 4.8 (The Manifest)

Service Excellence: 4.9 (The Manifest)

Value: 4.7 (The Manifest)

4.8/5 (G2)

The team excels at project management and effective communication through email and video conferencing. They’re also flexible, adjusting the team size as needed with competent resources. - Executive of a Fintech company, Florida, USA [source: Clutch]

I haven't found more skilled resources than Brainhub's team. - Managing Director of an Accounting Firm, United Kingdom [source: Clutch]

SKILLS: DevOps, workshops, hybrid mobile app development, wealth management tools, risk management, iOS app development, Android app development, PWAs, UX design, UI design, UX audit, UX workshops, architecture development, MVP, prototyping, product scaling, CI/CD, automated tests, BDD, TDD, information architecture, visual design, backend engineering, API development, serverless architecture, testing, Artificial Intelligence

WHAT CLIENTS APPRECIATE: technical knowledge, quality of the code, proactive attitude, project management abilities, transparency, engagement, dedication, curiosity, being a part of a client’s team, operational efficiency, specialized expertise

The team was knowledgeable and responsive to timelines and milestones, and they set a very frequent communication cadence. Additionally, they offered a very personable and collaborative approach. - Co-founder of a Crowdshipping app, Germany [source: Clutch]

COMPANY SIZE: 100+

LOCATION: Poland

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: The team believes in ownership and building strong relationships with clients and between team members. They support proactive behavior. Consistent growth, sharing knowledge, and close cooperation are very important to the team. After hours, they’re a bunch of friends who love to hang out together.

<span class="colorbox1" fs-test-element="box1"><p>Contact Brainhub and consult your project.</p></span>

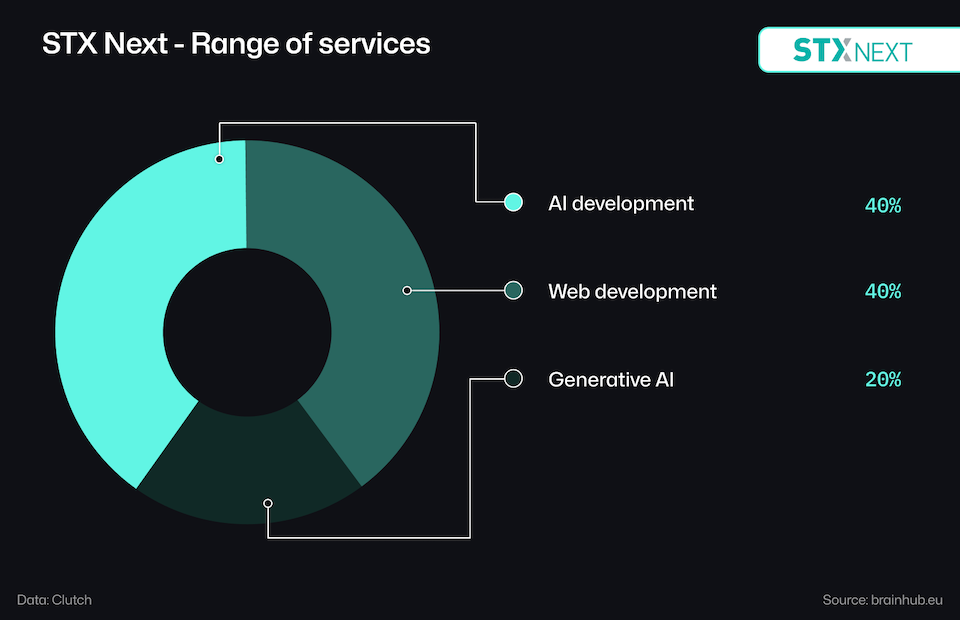

STX Next is a global IT consulting firm delivering AI-powered software solutions. With over 19 years of experience, the company offers a comprehensive range of services, including AI and data solutions, cloud consulting, product design, and technology consulting.

The team at STX Next emphasizes transforming vast datasets into actionable insights through AI, enabling businesses to analyze large datasets, detect patterns, and make informed decisions. Their cloud strategies aim to optimize operations by reducing IT costs and increasing efficiency, keeping clients ahead in the competitive landscape.

STX Next has collaborated with renowned organizations such as Canon, Decathlon, Unity, and Mastercard, delivering scalable and reliable software solutions. Their core delivery principles include continuous delivery, business-focused decision-making, and structured project governance, ensuring that projects align with clients' strategic objectives.

With a Clutch rating of 4.7/5 from 93 reviews, STX Next is recognized for its effective project management, timely delivery, and strong communication skills. Clients appreciate their commitment to quality and ability to handle complex challenges efficiently.

STANDS OUT FOR: AI expertise, cloud solutions, product design, technology consulting

SERVICES: AI and data solutions, cloud consulting, product design, technology consulting

TALENTS: AI specialists, cloud engineers, product designers, technology consultants

TECHNOLOGIES: Python, Node.js, .NET, React, Angular, Vue.js

SKILLS: Machine learning, data engineering, cloud strategy, product design, technology consulting

INTERNATIONAL CLIENTS: Canon, Decathlon, Unity, Mastercard

CLUTCH REVIEWS: 4.7 stars on Clutch from 93 reviews

APPRECIATED FOR: effective project management, timely delivery, strong communication skills, commitment to quality

CULTURE & VALUES: STX Next fosters a culture of continuous improvement and knowledge sharing. The company values effective communication and informed decision-making, encouraging team members to participate in the entire business process actively. This collaborative environment prioritizes client needs, leading to successful project outcomes.

METHODOLOGY: Agile methodologies

COMPANY SIZE: 500+ professionals

LOCATION: Poland, Mexico

INDUSTRY EXPERTISE: AdTech, EdTech, FinTech, eCommerce, Transport & Logistics

Orangesoft is a software development company with 13 years of experience, specializing in fintech app development. They offer full-cycle development services, including product discovery and tech consulting, UI/UX design, MVP development, quality assurance, and post-launch support. Their expertise ensures secure, scalable, compliant, and user-friendly fintech solutions tailored to your unique needs.

EXPERTS IN: Investment and wealth management apps, payment apps, personal finance apps, cryptocurrency wallet apps

RANGE OF SERVICES: Custom web and mobile app development, Security audits and testing, Fintech product development consulting, App modernization and support

TOP FINTECH CLIENTS: Most cases are under NDA, but the case studies include a Web 3.0 crypto wallet and a digital banking platform for the US and Nigeria.

THEY WORKED WITH: startups and mid-sized companies

TECHNOLOGIES:

Mobile: Swift, Kotlin, Java, Flutter, React Native

Frontend: React, Angular, Vue.js

Backend: Node.js, PHP, Python, Java, C++

TALENTS ON BOARD: Lead UI/UX Designer, iOS Developer, Head of Android Team, Business Analyst

REVIEWS:

Average Review Rating - 5.0/5 (Clutch)

Timeliness: 4.9 (The Manifest)

Service Excellence: 5.0 (The Manifest)

Value: 4.9 (The Manifest)

SKILLS: AI, machine learning, blockchain, AR/VR, cloud technologies, IoT, big data analytics.

WHAT CLIENTS VALUE: Orangesoft's clients appreciate their professionalism, technical skills, effective communication and project management, and the ability to deliver high-quality work on time and within budget.

COMPANY SIZE: 100+

LOCATION: Poland, US

PRICE RANGE: $50 - $99 / hr

10CLOUDS IN A NUTSHELL:

The company specializes in fintech and blockchain software development and consultancy. They strongly focus on providing user-friendly and cutting-edge fintech and banking solutions.

10Clouds joined forces with Trust Stamp, a leader in global identity verification, and developed solutions that meet the most rigorous security standards. They can be used while cooperating with enterprises and fintech companies to speed up the process. These are solutions like proof of liveliness, ID verification or identity lake.

10Clouds fintech team extends their partners’ blockchain and mobile development teams, supports teams while building platforms for secure data sharing, and helps fintech companies move to the cloud.

EXPERTS IN: banking systems, accounts integration, fintech mobile apps, enterprise financial software, wallet applications, secure data sharing

RANGE OF SERVICES: financial mobile app development services, financial web app development services, financial software development services, banking systems, enterprise financial software development, consulting

TOP FINTECH CLIENTS: Mambu, Tink, G-Coin, Lite ID, Crescent, Omise, Coinquista

THEY WORKED WITH: startups, medium-sized companies, enterprises

TECHNOLOGIES: React.js, Angular, React Native, Node.js, Vue.js, Swift, Flutter, Kotlin, Python, Elixir, Java

TALENTS ON BOARD: software engineers, QA engineers, DevOps engineers, blockchain developers, Cloud engineers, software architects, product designers, UX designers, delivery managers, agile project managers

REVIEWS:

4.9/5 from 84 reviews (Clutch)

Timeliness: 4.7 (The Manifest)

Service Excellence: 4.9 (The Manifest)

Value: 4.8 (The Manifest)

SKILLS: Artificial Intelligence, blockchain, cloud, DevOps, identity verification, machine learning, data sharing, customer experience, web development, mobile development, web design, product design, UX design, illustration, MLOps

WHAT CLIENTS APPRECIATE: transparency, cost-consciousness, engagement, flexibility, dedication, effective workflow and project management, code quality, professionalism

COMPANY SIZE: 200+

LOCATION: Poland (Warsaw, Poznan, Wroclaw)

FOUNDED IN: 2009

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: The team believes in mutual, constructive feedback as a part of showing appreciation. They also strive to recognize and celebrate achievements, as it increases happiness and engagement of the team. Care and appreciation are one of the main company values that keep the team united.

Geniusee is a custom fintech software development company. The organization provides tech solutions for various businesses, ranging from startups to large market players. They focus on delivering software that is sharp, seamless, and tailored to the specific needs of their clients. Their expertise spans across various sectors, including FinTech, EdTech, and Retail.

EXPERTS IN: digital banking solutions, blockchain, financial data management

RANGE OF SERVICES: web development services, custom software development services, financial software development services, AI development, cloud consulting, mobile app development

TOP FINTECH CLIENTS: Zytara Neobank, Finance Unlocked

THEY WORKED WITH: startups, medium-sized companies, enterprises

TECHNOLOGIES: Django, Node.js, React.js, React Native, Java, Kotlin, Python, Swift, TypeScript

TALENTS ON BOARD: software engineers, frontend developers, backend developers, DevOps engineers, QA engineers, project managers, business analysts, UX designers, UI designers

REVIEWS:

5.0/5 based on 57 reviews (Clutch)

Timeliness: 4.9 (The Manifest)

Service Excellence: 5.0 (The Manifest)

Value: 4.8 (The Manifest)

5/5 (G2)

SKILLS: software engineering, product design, Data Science & AI, digital banking solutions, blockchain, financial data management, payment security, predictive analytics, UX design

WHAT CLIENTS APPRECIATE: professionalism and transparency in the development process, technical expertise, responsiveness, dedication to the success of the project

COMPANY SIZE: 100+

LOCATION

Headquarters: Middletown, DE, USA

Other Locations: Warsaw, Poland; Kyiv, Ukraine; Lviv, Ukraine

FOUNDED IN: 2017

PRICE RANGE: $25 - $49 per hour

CULTURE & VALUES: Geniusee is a multifaceted organisation with a group of highly skilled technological experts. They are renowned for their commitment, diligence, and initiative when working on projects. Effective communication, professionalism, and transparency are highly valued by the company.

CheesecakeLabs, a financial software development company based in Brazil, specialising in web and mobile development. They provide a variety of teams that can handle different projects' requirements. They were identified as the 5th best React Native development company and the 10th best global mobile app development company by Clutch. Additionally, they were featured on the prestigious Great Place to Work list.

EXPERTS IN: blockchain, web development, payment systems

RANGE OF SERVICES: mobile application development, web app development, finance software development, website development, UX/UI design, strategy and product definition

TOP FINTECH CLIENTS: MonetGram, Stellar, Fig Loans, Cresol Pay

THEY WORKED WITH: startups, medium-sized companies, enterprises

TECHNOLOGIES: React Native, Flutter, React, Python, Node.js

TALENTS ON BOARD: software engineers, QA engineers, mobile engineers, designers, project managers, product owners

REVIEWS:

4.9/5 from 52 reviews (Clutch)

Timeliness: 4.8 (The Manifest)

Service Excellence: 4.9 (The Manifest)

Value: 4.6 (The Manifest)

SKILLS: native mobile apps, cross-platform mobile applications, iOS app development, Android app development, quality assurance, testing, project management, UX, UI, Progressive Web App, IoT, Connected Hardware, Voice Assistants, Blockchain, wearables, MVP specifications, MVP development, information architecture, visual design, prototyping, backend engineering

WHAT CLIENTS APPRECIATE: meeting project deadlines, great product management, responsiveness, professionalism, proactive communication, thinking out of the box, top productivity, transparency

COMPANY SIZE: 100+

LOCATION: Brazil (Florianopolis)

FOUNDED IN: 2013

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: adaptability, excellence, taking responsibility, lucid communication, deference, information sharing, tight cooperation

Future Processing is a Polish software consulting company. With a focus on digital transformation through the use of machine learning, cloud, and data solutions, they provide fintech software development services. The organization offers advising services in addition to helping with the project's discovery phase. They won Strategic Sourcing Awards and have been a Microsoft partner since 2007. Clutch identified them as one of Poland's Top Developers.

EXPERTS IN: blockchain, banking apps, loan apps

RANGE OF SERVICES: custom software development, software design, support & maintenance, digital transformation, cloud services, legacy modernization

TOP FINTECH CLIENTS: Crédit Agricole Bank, 4 finance, Euromoney

THEY WORKED WITH: startups, medium-sized companies, enterprises

TECHNOLOGIES: .NET, Java, Angular, C++, PHP, Python, Node.js, React, React Native, MongoDB

TALENTS ON BOARD: software developers, solution architects, DevOps engineers, Big Data architects, QA engineers, business analysts, scrum masters, delivery managers, UX/UI designers, graphic designers

REVIEWS:

4.7/5 from 42 reviews (Clutch)

Timelines: 4.5 (The Manifest)

Service Excellence: 4.7 (The Manifest)

Value: 4.4 (The Manifest)

SKILLS: strategy workshop, discovery workshop, custom financial software, banking services, design sprint workshop, business intelligence, data science, Machine Learning, cloud solutions, data solutions, AWS, Azure, PoC development, IoT, AI, Big Data, DevOps, business analysis, testing, Quality Assurance, software architecture, quality audits, security audits, usability and accessibility audits, software audits

WHAT CLIENTS APPRECIATE: top-notch project management skills, predictability, professionalism, expertise, high quality of work, being goal-oriented, focus on people and building relationships, operational efficiency

COMPANY SIZE: 1000+

LOCATION: Poland, Switzerland, UK, Germany, Ukraine

FOUNDED IN: 2000

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: highest quality, passion, commitment, expanding knowledge and skills, openness, trust, positive atmosphere, team spirit

Monterail is a financial software development company with a focus on AI-enhanced digital product development. They are present on the market for over 13 years. They have a team of experts dedicated to building innovative software solutions for industry leaders. The organization have successfully delivered more than 390 projects to over 235 clients worldwide. They are an official Vue.js partner.

EXPERTS IN: finance management apps, M&A deal platform

RANGE OF SERVICES: web development, mobile app development, financial software development, product design, AI development, web design

TOP FINTECH CLIENTS: Uncap, ZebPay, DealGlobe

THEY WORKED WITH: startups, medium-sized companies, enterprises

TECHNOLOGIES: Ruby, JavaScript, Python, TypeScript, Ruby on Rails, VueJS, Angular, Flutter, Node.js, React, React Native, Django

TALENTS ON BOARD: software engineers, software architects, QA engineers, product designers, UX designers, project managers

REVIEWS:

4.8/5 based on 49 reviews (Clutch)

Timeliness: 4.6 (The Manifest)

Service Excellence: 4.8 (The Manifest)

Value: 4.3(The Manifest)

SKILLS: web app development, mobile app development, UI/UX Design, Artificial Intelligence, digital product development, product strategy

WHAT CLIENTS APPRECIATE: adaptability, speed of work, high-quality performance, effective communication, understanding of client's objectives, ability to perform under pressure

COMPANY SIZE: 150+

LOCATION: Wrocław, Poland

FOUNDED IN: 2010

PRICE RANGE: $50 - $99 per hour

CULTURE & VALUES: long-term partnerships, human approach, adaptability to client's needs

MIQUIDO IN A NUTSHELL:

Miquido is a fintech software development company that provides end-to-end fintech software development services - from strategy and market research, through design, to development and support. This process allows the company to spot the needs of a business and provide a user-center product.

Miquido implements Machine Learning features and Data Science solutions to financial and banking products they create. Expertise in Artificial Intelligence allows them to implement chatbots or voice assistants into insurtech products. The company cares about both security and performance of the fintech apps they deliver.

They are experienced in building various financial products: trading platforms, investment applications, banking apps, and digital wallets. Their fintech applications for Nextbank have been recognized by Singapore Fintech Festival 3 years in a row.

EXPERTS IN: in-app bank account management, Customer relationship management app for insurance agents, financial mobile platforms, web and mobile trading platforms, investment applications, stock exchange apps, advanced savings calculators

RANGE OF SERVICES: banking app development, digital wallets, financial software development, mobile banking apps, insurance app development, financial app development, financial mobile platform development

TOP FINTECH CLIENTS: BNP Paribas (GOmobile project), Aviva, NextBank, PZU, Monetas

THEY WORKED WITH: small and medium-sized companies, corporations

TECHNOLOGIES: JavaScript, Angular, React, Node.js, Golang, Java, Flutter, Swift, Kotlin, TypeScript, Kubernetes

TALENTS ON BOARD: software developers, frontend developers, backend developers, tech leaders, software testers, visual designers, product designers, UX/UI designers, project managers

REVIEWS:

4.9/5 from 45 reviews (Clutch)

Timeliness: 4.8 (The Manifest)

Service Excellence: 4.9 (The Manifest)

Value: 4.8(The Manifest)

SKILLS: Cloud Core Banking, Web Internet Banking, Mobile Internet Banking, Agency Banking, AI Credit Scoring, Artificial Intelligence, Machine Learning, Data Science, Computer Vision, AWS, Google Cloud Platform, cloud app development, cloud deployment, UX design, UI design, Business Intelligence, product strategy, workshop, NLP, market research, prototyping, PoC

WHAT CLIENTS APPRECIATE: reliability, flexibility, consistency, quick turnaround time, ability to onboard rapidly, versatile range of skills and capabilities, transparency, communication skills, commitment, work ethic.

METHODOLOGY: Agile methodology

COMPANY SIZE: 200+

LOCATION: Poland (Cracow)

FOUNDED IN: 2011

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: The team treasures transparency and honesty - also in terms of advising better solutions for their clients. Delivering business value is crucial for the company. They put people first, caring about their personal growth, competence development, and overall satisfaction.

KINDGEEK IN A NUTSHELL:

KindGeek is a full-cycle fintech software development company. They have a strong business mindset, and transparency and trust are one of their main values.

KindGeek offers a full spectrum of financial software development services - from ideation to deployment. The company also provides business analysis and cybersecurity services. The company claims that over 80% of its projects lay in the finance industry.

The team believes in a product-oriented approach, so they recommend including a discovery phase into product development which saves up to 20% of development time. In their process of building digital banking software they always use design thinking, which allows them to build customer-centric products with great user experience.

EXPERTS IN: finance management platforms, blockchain platforms, insurance software, mobile payments, payment solutions

RANGE OF SERVICES: digital banking solutions, e-banking systems, mobile banking, cybersecurity services, blockchain platform development, fintech mobile apps, fintech web apps, insurance software development, payment solutions

TOP FINTECH CLIENTS: HyperJar, Tradeshift, LifeWallet

THEY WORKED WITH: startups, medium-sized enterprises, corporations

TECHNOLOGIES: JavaScript, Angular, React.js, Vue.js, Node.js, Java, .NET, PHP, MySQL, PostgreSQL, MongoDB, Oracle, Flutter, Firebase, Swift, Kotlin, Objective C

TALENTS ON BOARD: software engineers, QA engineers, DevOps engineers, UX/UI designers, business analysts, project managers

REVIEWS:

4.8/5 stars from 56 reviews (Clutch)

Timeliness: 4.6 (The Manifest)

Service Excellence: 4.8 (The Manifest)

Value: 4.7(The Manifest)

SKILLS: Data Science, Cloud technologies, blockchain, business analysis, Artificial Intelligence, Machine Learning, Data Science, Cloud, UX design, UI design, chatbots, digital banking solutions, mobile-only banks,

WHAT CLIENTS APPRECIATE: communication skills, tech skills, project management skills, flexibility, collaborative and effective approach, attentiveness to client’s needs, responsiveness to feedback, reliability, delivering on time.

METHODOLOGY: Agile methodology

COMPANY SIZE: 100+

LOCATION: Poland (Cracow)

FOUNDED IN: 2013

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: Trust is the team’s highest value. According to the team, there’s no growth without honest feedback. They also appreciate the sense of beauty, striving to create products that are visually appealing. They treasure team spirit and the quality of delivered work.

DICEUS IN A NUTSHELL:

Diceus is a fintech software development company that strongly focuses on fintech, banking, and insurance software development. They use artificial intelligence, blockchain, big data, and cloud solutions to boost the financial software they create.

They provide services like payment solutions, blockchain solutions for banking, building online banking systems, and mobile banking solutions.

The company ensures professional technical advisory and support. They provide clients with NDAs at the initiation stage and have strong data security and protection procedures. They understand that a seamless user experience is crucial to increasing customer loyalty.

EXPERTS IN: banking legacy application modernization, online payments, payment processing, payroll processing, B2B insurance services, VAT processing applications, insurance broker software solutions, data warehouse, data aggregation, data migration

RANGE OF SERVICES: lending management software, blockchain solutions, regtech, payments software solutions, blockchain fintech app development, loan management software, money transfer app development, fintech application development, mobile banking apps, IT consulting, system integration, insurance software development, online banking, core banking systems, mobile banking

TOP FINTECH CLIENTS: Risk Point, Bank al Etihad, Teambase, BriteCore

THEY WORKED WITH: small and medium-sized companies, corporations

TECHNOLOGIES: React.js, Node.js, Vue.js, Angular.js, Golang, Flutter, Java, .NET, Python, PHP, Ruby, Objective.C

TALENTS ON BOARD: frontend developers, backend developers, designers, architects, QA and test engineers, business analysts, project managers

REVIEWS:

4.9/5 from 47 reviews (Clutch)

Timeliness: 4.9 (The Manifest)

Service Excellence: 4.9 (The Manifest)

Value: 4.6(The Manifest)

4.7/5 (G2)

SKILLS: DevOps, Artificial Intelligence, Machine Learning, blockchain, big data, cloud solutions, data science, cross-platform apps, payment gateway development, payment integration services, contactless payments and POS, real-time payments, Digital Ledger Technology, smart contracts, banking loan software solutions, fintech money lending software, loan module in core banking, loan decisioning software, money transfer functionalities, CRM, mobile banking apps, payment applications, IoT, ERP, Robotic Process Automation, system integration, software architecture

WHAT CLIENTS APPRECIATE: responsiveness, professionalism, and organizational skills, result-oriented approach, effective communication, expertise, timely reporting, commitment and dedication

METHODOLOGY: Agile methodology

COMPANY SIZE: 100+

LOCATION: Ukraine (Kyiv), Denmark (Hellerup), Lithuania (Alytus), USA (New York City)

FOUNDED IN: 2011

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: The company’s mission is to deliver high quality. They want to bring as many values as possible with the right technology and people. They combine expertise with a quality-driven delivery model.

S-PRO IN A NUTSHELL:

S-Pro provides software engineering and consulting services for banks, financial companies, and startups. They offer dedicated teams with fintech specialization, delivering strong domain expertise for their clients. The company focuses on accelerating its partners’ growth.

S-Pro has expertise in digital banking, lending software, crypto wallets, exchange platforms, insurtech, and stock trading platforms.

They are also experts in blockchain technology, providing white-label and custom blockchain solutions. The team has experience in software architecture, banking API, and payment solutions integration.

EXPERTS IN: fintech mobile apps, fintech web apps, real-time risk management platforms, crypto-wallets, crypto-trading platforms, banking API and payment solutions integration, B2B payment solutions

RANGE OF SERVICES: digital banking software development, loan management tools development, e-commerce payment systems development, crypto-exchange platform development, NFT marketplaces, crypto wallets and extensions, insurtech, blockchain development, stock trading platforms development

TOP FINTECH CLIENTS: MeterQubes, Crypto Wallet, Refundmatic

THEY WORKED WITH: enterprises, startups

TECHNOLOGIES: React.js, Angular.js, Node.js, Python, Java, Golang, PHP, Laravel, Firebase, React Native, Flutter, Swift, Kotlin

TALENTS ON BOARD: software engineers, frontend developers, backend developers, tech leaders, QA engineers, UX/UI designers, DevOps engineers, project managers, business analysts

REVIEWS:

4.9/5 stars from 45 reviews (Clutch)

Timeliness: 4.9 (The Manifest)

Service Excellence: 4.9 (The Manifest)

Value: 4.8(The Manifest)

SKILLS: blockchain, API development, Big Data, cloud, DevOps, branding, cloud engineering, Artificial Intelligence, Machine Learning, UX design, UI design, architecture, PoC, infrastructure engineering, MVP, product migration strategy, quality assurance, banking infrastructure, neo banks, loan management software, loan comparison tools, mobile lending apps, P2P lending marketplace, BNPL & EPP, e-voting systems, DeFi & CBDC solutions, fraud prevention/detection, marketplaces, trading bots

WHAT CLIENTS APPRECIATE: outstanding ability to deliver, professional yet friendly communication, responsiveness, being a reliable partner, energetic approach, excellent project management, engagement, flexibility

METHODOLOGY: Agile methodology

COMPANY SIZE: 250+

LOCATION: Ukraine (Kyiv)

FOUNDED IN: 2014

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: The team strongly focuses on continuous improvement and thirst for knowledge. They pride themselves on having a product mindset. They treasure high-quality and innovative approach.

NETGURU IN A NUTSHELL:

Netguru is a global software agency with almost 15 years of experience and over 700 employees on board. The company helps fintech businesses create personalized, customer-centric products that respond to modern clients’ requirements.

Netguru helps banks in reviewing their digital journey and refining the user experience of their apps and websites. They deliver banking platforms and fintech mobile apps.

The company provides both consulting and fintech software development services. They use blockchain to secure online payments. They also help fintech companies to discover new business model ideas.

EXPERTS IN: banking platforms, supporting fintech startups, investment platforms, digital wealth solutions, banking-as-a-service, helping financial advice sector

RANGE OF SERVICES: financial product development, omnichannel banking experience, improving customer support, enhancing security, mobile banking apps, digital banking tools development, financial process automation, online payments audit, customer loyalty program development, insurance cloud services, banking as a platform, new business model discovery, insurance products and services, digital wealth solutions, wealth management tools, digital banking tools development

TOP FINTECH CLIENTS: Solarisbank, Moonfare, AdviceTech, CashCape

THEY WORKED WITH: enterprises, startups, medium-sized companies

TECHNOLOGIES: Ruby on Rails, React.js, Node.js, Python, Django, React Native, Flutter

TALENTS ON BOARD: software engineers, software architects, DevOps engineers, data engineers, UX designers, UI designers, product designers, QA engineers, project managers

REVIEWS:

4.8/5 stars on Clutch from 54 reviews

Timeliness: 4.6 (The Manifest)

Service Excellence: 4.8 (The Manifest)

Value: 4.3 (The Manifest)

4.5/5 (G2)

SKILLS: blockchain, Machine Learning, AI, digital transformation, business intelligence, cybersecurity, cloud-based software, customer experience, chatbots, NLP, digital workflows, biometric verification, UX design, workflow automation, CRM

WHAT CLIENTS APPRECIATE: flexibility, commitment, engagement, openness to learn, quality, generating innovative suggestions, overcoming time zone challenges, strong relationships with clients’ team members

METHODOLOGY: Agile methodology

COMPANY SIZE: 900+

LOCATION: Poland (Poznań)

FOUNDED IN: 2008

PRICE RANGE: $50 - $99 / hr

CULTURE & VALUES: The team never settles for "good enough" and aims to exceed the client's expectations. One of their biggest values is ownership. They believe in the power of questioning the status quo. They love experiments and learning from both successes and failures. They value partnership and continuous growth.

Fintech companies need to deal with compliance regulations, financial apps need to be extra secure, and as a client, you need to remember about the security of your business. Here are a few tips on how to deal with that, and examples of how companies from this ranking are dealing with those issues.

Fintech companies need to pay extra attention to securing their systems against penetration, malware, and data leaks.

Data encryption (encoding information into a code that requires special keys to be able to decipher it) and tokenization (replacing sensitive data with a generated number) are basic measures for that. Strong password policy and precise authentication technologies also.

But cybersecurity is an ongoing process. DevSecOps helps to integrate it to the fintech software development life cycle. It imposes testing throughout the whole development process and running penetration tests.

Fintech software developers need to be experts in data encryption, ensuring secure application logic, and penetration testing.

There’s a variety of federal and local laws that regulate how fintech businesses collect and use personal data. These are, for example, the Gramm-Leach-Bliley Act or the Federal Trade Commission Act in the US, and GDPR in Europe.

Brainhub ensures GDPR compliance for every project. Diceus offers consulting for banks when they help to resolve compliance issues quickly and provide RPA integration to help banks improve their compliance with regulations and risk management. S-Pro offers consultations to help fintech companies understand the restrictions and conditions in the financial industry.

Intellectual Property over the technology and code should be transferred to your company. It needs to be stated in a contract. Always check the contract and make sure IP rights are transferred to you.

NDA is a basic measure of protecting your intellectual property. A non-disclosure agreement is signed to establish confidentiality. It creates a legal framework for protection ideas and information.

There are also other measures of protecting IP rights, like non-compete agreements, non-binding letters of intent, or regulations around data access, server access, and API access.

The companies listed below specialize in modernizing legacy fintech systems:

Custom fintech software - custom software development for the fintech industry includes solutions for banking, insurance, lending, billing, investing, or wealth management. Various solutions for web and mobile platforms improve user engagement and real-time data interaction.

<span class="colorbox1" fs-test-element="box1">Providers: Brainhub, Orangesoft, 10Clouds, Diceus, KindGeek, Miquido, Netguru, S-Pro</span>

Digital banking - secure and consumer-friendly banking applications improve customer experience, customer service, and make operation smoother.

<span class="colorbox1" fs-test-element="box1">Providers: 10Clouds, Diceus, KindGeek, Netguru, Miquido, S-Pro</span>

Expense management software - smart applications for personal finances help users manage their savings and investments, and plan their budgets.

<span class="colorbox1" fs-test-element="box1">Providers: Brainhub, Orangesoft, Netguru, S-Pro</span>

Fintech UX/UI design - user experience cannot be underestimated in fintech software. Users expect fintech applications to be pleasant to use, accessible, to solve their problems, and make it easier to reach their goals. Thoughtful UX design drives excellent customer experience.

<span class="colorbox1" fs-test-element="box1">Providers: Brainhub, Orangesoft, Netguru</span>

Fintech mobile apps - various products from innovations for startups to financial management apps and digital banking solutions.

<span class="colorbox1" fs-test-element="box1"> Providers: Brainhub, Orangesoft, 10Clouds, Diceus, KindGeek, Miquido, S-Pro</span>

Insurtech software - digital products developed to increase the efficiency of insurance companies. Insurtech solutions are used by insurance agencies or brokers to improve their operations, increase customer engagement, and improve billing efficiency.

<span class="colorbox1" fs-test-element="box1">Providers: Diceus, KindGeek, Miquido, S-Pro</span>

Lending software - applications facilitate fast loan approval and online verification. The loan decision process can be automated and user-friendly.

<span class="colorbox1" fs-test-element="box1">Providers: Diceus, Miquido, S-Pro</span>

Mobile banking software - mobile applications allow customers to access their banking accounts on their mobile phones. Users can, for example, make real-time payments, pay bills, or monitor their accounts.

<span class="colorbox1" fs-test-element="box1">Providers: 10Clouds, Diceus, KindGeek, Netguru, Miquido, S-Pro</span>

Online banking software - online banking allows customers to manage their accounts online, without the need to visit banks. Online banking evolved over recent years, introducing solutions like voice assistants, and seriously improving security.

<span class="colorbox1" fs-test-element="box1">Providers: 10Clouds, Diceus, KindGeek, Netguru, Miquido, S-Pro</span>

Payment solutions - applying payment solutions to apps includes developing custom payment gateways or configuring ready-made ones.

<span class="colorbox1" fs-test-element="box1">Providers: Orangesoft, Diceus, KindGeek, Netguru</span>

Payment systems and payment processing software - systems help to improve the security and transparency of payments. Solutions allow receiving and sending payments automatically.

<span class="colorbox1" fs-test-element="box1">Providers: Diceus, KindGeek, Netguru</span>

Robotic Process Automation - RPA bots take over the financial processes to enhance the productivity of employees.

<span class="colorbox1" fs-test-element="box1">Providers: Diceus</span>

Wealthtech software - digital solutions that transform the investment and asset management industry. Robo advisors, micro-investments, and digital brokers are often used here.

<span class="colorbox1" fs-test-element="box1">Providers: Brainhub, Orangesoft, Netguru</span>

.avif)

The term fintech is short for Financial Technology. It includes applications and software built for various financial institutions and companies. It helps to better manage the operations and processes of companies, and improve customer experience, responding to the demands of a modern user. Among fintech software, we have online banking, mobile banking, online lending, personal finance management apps, or crypto wallets. The goals of fintech are to make financial operations more secure, efficient, accessible, and pleasant for the users.

Fintech apps can be developed using various technologies, like JavaScript, Python, Java, PHP. The choice of languages and frameworks should be adjusted to a particular project’s needs, and in the case of fintech apps, a development team needs to put much effort into security and performance. Besides that, to add an extra layer of security or innovation into fintech apps, developers use artificial intelligence, blockchain, big data, or robotic process automation.

The future of fintech will most likely be tied with blockchain technology since it improves the security level of apps and platforms. Cryptocurrencies, Robo advisors, neobanks - they attract the interest of investors and, as McKinsey report says, along with IoT, cloud computing, no-code, SaaS, and AI will continue to shape the future of fintech in the next 10 years.

A financial software developer focuses on building various software solutions for financial institutions like banks or insurance companies, fintech companies and startups, as well as financial solutions for corporations. A fintech software developer should communicate well with the design team because customer experience is extremely important in the case of innovative fintech products. A good fintech engineer should also understand the business side of projects well, have strong cybersecurity-related skills, and know how to improve the performance of an app.

In 2021, Stripe was the number 1 fintech company from the USA. As of 2023, Stripe was valued at around $50 billion after its latest funding round. Klarna, a “buy now, pay later” trailblazer was the second, and Kraken, the largest cryptocurrency exchange by transaction volume in Europe, the third. Among the top fintech companies are also Visa (US), Mastercard (US), and Ant Financial (China).

According to the FinTech magazine, in 2022 we should watch BlockFi, a US-based company that specializes in crypto-asset lending. The company secured $850 of new funding last year. Sifted.eu, a Financial Times-backed startup that explores the European startup market, mentions Juni, a Swedish neobank built for e-commerce merchants.

To select top financial software development companies worldwide, we’ve analyzed their websites, pages on ranking portals, reviews, testimonials, and content they produce.

Companies listed here:

You can proceed with your research by going through other rankings or contacting companies that caught your attention right away.

Remember to check the details about their portfolio and talk to previous fintech clients. Pay attention to cultural fit and the natural flow between you and a vendor.

After choosing a partner, make sure you will be the owner of the source code and establish clear rules of collaboration.

Good luck!

<span class="colorbox1" fs-test-element="box1"><p>Look no further!</p><p>Chat about your fintech project with our advisors. Let’s find out if we’re a match, no strings attached.</p></span>

Our promise

Every year, Brainhub helps founders, leaders and software engineers make smart tech decisions. We earn that trust by openly sharing our insights based on practical software engineering experience.

Authors

Read next

Popular this month